Mental Health And Financial Well-Being

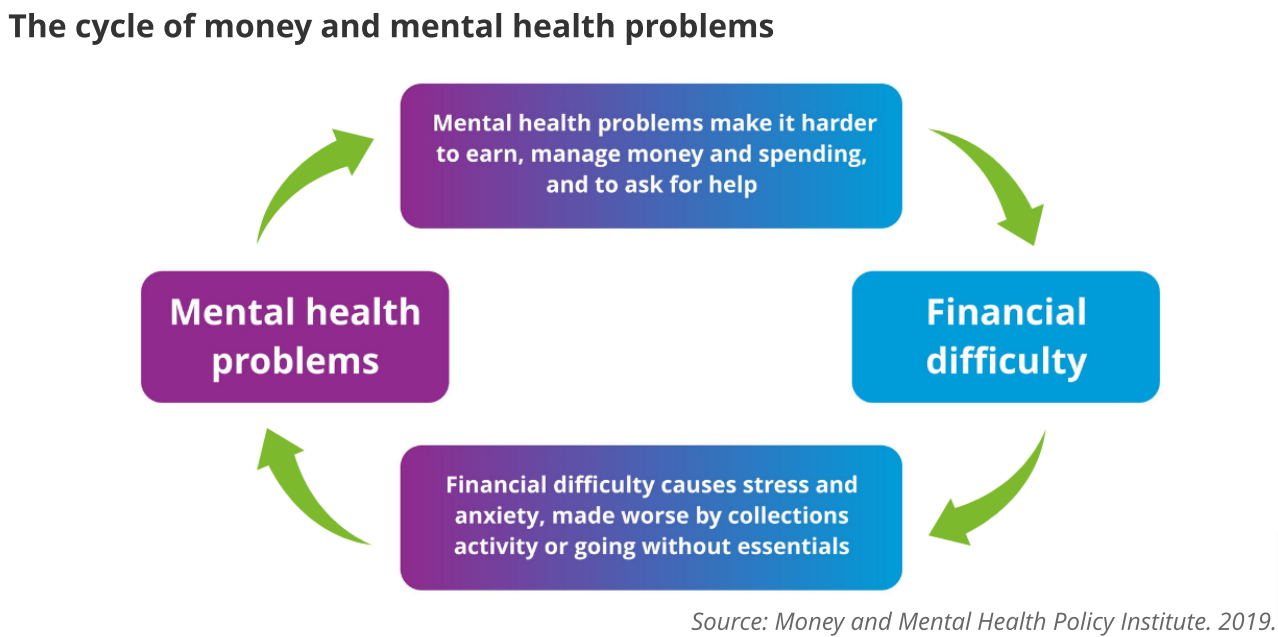

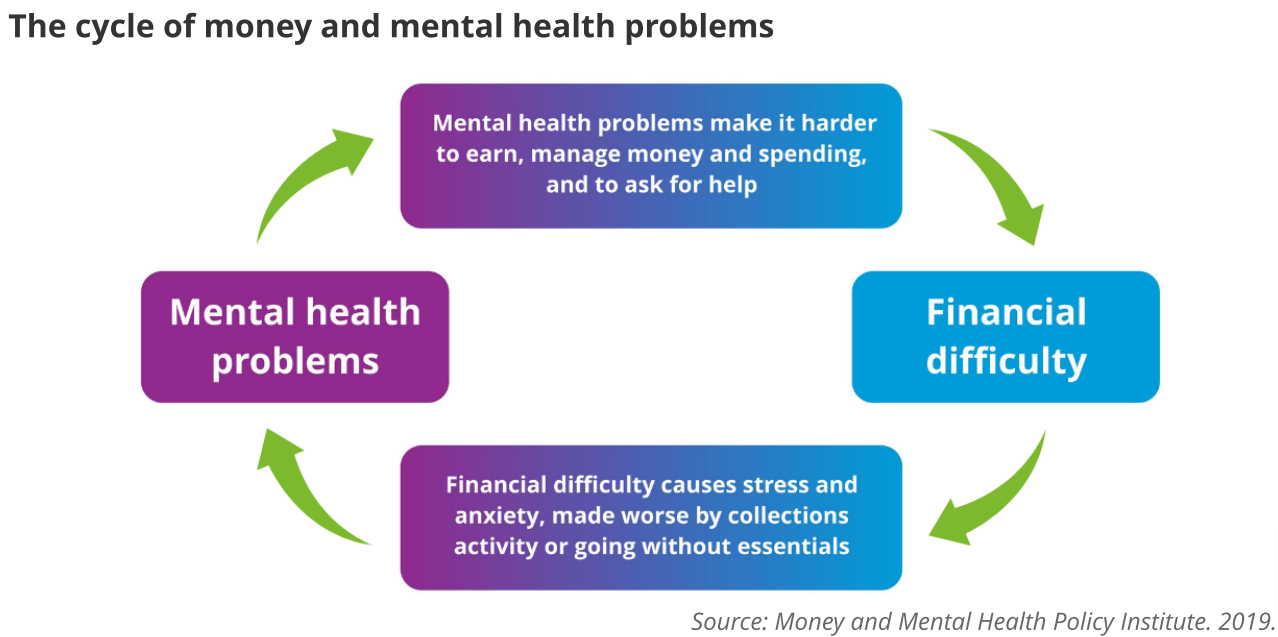

Financial strain has been linked to increased rates of mental health issues, an often-overlooked relationship contributing to significant societal burdens. Consider the ripple effect when someone loses a job; beyond the immediate economic impact, the mental stress can be profound. Experts often see this correlation as a catalyst for anxiety and depressive disorders.

Historically, financial distress has manifested as a key predictor of mental health outcomes. For instance, a study reveals that those with high levels of debt are more than twice as likely to experience mental illnesses. Harnessing financial literacy programs and mental health support can mitigate these intertwined challenges effectively.

The Connection between Mental Health and Financial Well-being

Financial well-being and mental health are deeply connected. When people face financial problems, their stress levels can increase significantly. This stress can lead to mental health issues such as anxiety and depression.

Studies show that financial instability can trigger mental health problems. For instance, someone who is worried about paying their bills may struggle to sleep or concentrate. This can affect their overall well-being.

It's important to understand how financial struggles impact mental health. By recognizing this link, we can better support those in need. Offering financial education and mental health resources can make a big difference.

Several organizations provide resources for both financial and mental well-being. These include budgeting tools and counseling services. Utilizing these resources can help individuals achieve a balanced and healthy life.

Impact of Debt on Mental Health

Debt has a powerful impact on mental health. When people are in debt, they often feel overwhelmed and hopeless. These feelings can quickly turn into anxiety and depression.

Debt-related stress can also affect physical health. People may experience headaches, insomnia, and other stress-related symptoms. As a result, their quality of life decreases.

Resourceful debt management and financial counseling can help mitigate these effects. Seeking professional help can provide effective strategies to manage debt. This, in turn, improves mental well-being.

Importance of Financial Literacy

Financial literacy plays a crucial role in mental health. Understanding how to manage money reduces financial stress. It empowers individuals to make informed decisions.

Basic financial skills, like budgeting and saving, can improve one's sense of control. When people feel in control of their finances, they are less likely to experience anxiety. They can focus on other aspects of life, leading to better overall health.

Many schools and organizations offer financial literacy programs. These programs teach vital money management skills. Participating in these programs can have long-term benefits for mental health.

Programs for Integrated Support

Some programs offer integrated support for financial and mental health. These programs address the intertwined nature of these issues. By combining resources, they provide holistic care.

For example, some initiatives offer workshops on both budgeting and stress management. This dual approach helps individuals tackle financial and mental challenges simultaneously. It creates a supportive environment for comprehensive well-being.

Utilizing such integrated programs can lead to sustainable improvements. Individuals gain valuable skills that benefit both their finances and mental health. This holistic support fosters a balanced and healthy lifestyle.

Exploring the Impact of Financial Stress on Mental Health

Financial stress can severely impact an individual's mental health. When people worry about money, it can lead to anxiety and depression. Understanding this connection can help mitigate negative effects.

Signs of Financial Stress

Recognizing the signs of financial stress is crucial. Common symptoms include constant worry about money and trouble sleeping. Physical symptoms, such as headaches and fatigue, are also common.

People often feel overwhelmed and hopeless. These feelings can make it hard to function daily. Stress can also strain personal relationships.

Identifying these signs early can lead to better management. Speaking with a counselor can provide strategies to cope. Support networks are essential in this process.

Coping Mechanisms for Financial Stress

There are various coping mechanisms to deal with financial stress. One effective method is creating a budget. Budgeting helps people feel more in control of their finances.

Another useful strategy is seeking financial advice. Professionals can offer tailored advice to improve financial situations. This support can reduce stress significantly.

Mindfulness and relaxation techniques also aid in stress relief. Yoga, meditation, or simple breathing exercises can be helpful. Combining these methods provides a comprehensive approach to managing stress.

Long-term Effects of Financial Stress

Prolonged financial stress can have long-term effects on mental health. Chronic stress can lead to severe depression and anxiety disorders. It's also linked to physical health issues like heart disease.

Long-term stress can affect job performance and productivity. Individuals may struggle to concentrate or make decisions. This can result in a cycle of financial instability.

Addressing financial stress early can prevent these outcomes. Financial literacy and mental health resources are vital. They provide the knowledge and support needed to break the cycle.

Case Studies: Real-life Examples of Financial Well-being Affecting Mental Health

Case studies provide insight into how financial well-being impacts mental health. For example, Emily, a single mother, faced financial difficulties after losing her job. The stress from her financial situation led to severe anxiety and sleepless nights.

Another case is John, a college student with student loans. The pressure of paying back his loans caused depression and affected his academic performance. His school provided counseling, helping him manage both his mental and financial health.

Lisa’s story shows the positive effect of good financial planning. She started budgeting and saving early, avoiding the stress related to financial uncertainty. As a result, she enjoys a stable mental state and feels more secure.

These examples highlight the direct link between financial stability and mental health. By learning from these cases, more people can take steps to improve their financial well-being. This in turn, supports better mental health.

Understanding How to Alleviate Financial Stress for Better Mental Health

Alleviating financial stress can greatly improve mental health. One effective method is to create a detailed budget. A budget helps track expenses and manage funds better.

Another approach is learning about financial literacy. Understanding financial terms and principles can empower individuals. This knowledge reduces anxiety related to money management.

Seeking professional advice is also beneficial. Financial advisors can provide personalized strategies to handle financial issues. They help create a roadmap for achieving financial goals.

Practicing mindfulness and relaxation techniques can relieve stress. Activities like meditation, yoga, and deep breathing exercises are helpful. These techniques promote a calm mind and better decision-making.

Social support plays a crucial role in alleviating financial stress. Joining support groups or talking to friends and family can offer emotional relief. Sharing experiences and solutions can reduce feelings of isolation.

Utilizing available resources is essential for maintaining financial and mental health. Many organizations offer free financial counseling services. These resources provide guidance and support to achieve financial stability.

Role of Financial Literacy in Promoting Mental Well-being

Financial literacy is crucial for mental well-being. Understanding how to manage money gives people confidence and reduces stress. This knowledge helps individuals make informed decisions.

Learning financial skills can be very empowering. People who know how to budget and save feel more in control. This sense of control positively impacts their mental health.

Programs that teach financial literacy can bridge gaps in knowledge. Schools and community centers often offer these courses. These programs equip participants with the tools they need to manage their finances effectively.

Financially literate individuals can avoid common pitfalls. They are less likely to incur unnecessary debt or fall for scams. This protection contributes to lower anxiety levels.

Furthermore, financial literacy promotes long-term planning. Individuals can set and achieve financial goals, such as saving for a home or retirement. Reaching these milestones boosts self-esteem and security.

Investing in financial literacy is an investment in mental well-being. It's not just about money; it's about peace of mind and future stability. The more people know, the better they can care for their mental health.

Integrative Support: Combining Financial and Mental Health Services

Combining financial and mental health services offers a holistic approach to well-being. Many organizations now recognize the interconnectedness of these two areas. These programs provide resources to address both financial and mental challenges simultaneously.

For example, some clinics offer joint counseling sessions. These sessions include both financial advisors and mental health professionals. This teamwork ensures that individuals receive comprehensive support.

Incorporating these services can greatly benefit those in need. By tackling both areas, people can find more effective solutions to their problems. The integrated approach promotes lasting change and overall well-being.

An integrated support program may offer workshops. These workshops cover topics like budgeting, stress management, and healthy coping mechanisms. Participating in these sessions can improve both financial literacy and mental health.

Support groups are another key component of these programs. In these groups, individuals can share experiences and solutions. This communal aspect helps reduce feelings of isolation and provides emotional support.

Overall, integrating financial and mental health services creates a strong foundation for a balanced life. It ensures that both areas are addressed, leading to better outcomes. With the right support, people can achieve greater financial stability and mental health.

The Future of Mental Health and Financial Well-being

The future of mental health and financial well-being looks promising with new initiatives on the horizon. Innovative programs are being developed to simultaneously address financial literacy and mental health. These integrated approaches offer comprehensive support for individuals in need.

Technology will play a significant role in this evolution. Apps that combine budgeting tools with mental health resources are becoming more common. These apps provide users with easy access to both financial advice and mental health support.

Employers are also recognizing the importance of addressing these issues together. Many companies plan to introduce programs that focus on employee well-being holistically. This could include financial counseling services alongside wellness programs.

Education systems may soon incorporate lessons on financial literacy tied to mental health awareness. Schools will likely teach students how managing money wisely can reduce stress. Early education will prepare future generations for a balanced life.

Government policies could further support this integration by funding relevant initiatives. Grants might be made available for community centers offering combined services. Increased funding can enhance the reach and impact of these programs.

The focus on preventive measures will rise as well. Rather than just treating symptoms, newer strategies aim to prevent issues from arising. By fostering a culture that values both financial stability and mental health, society can build a brighter future.

Resources for Achieving Mental Health and Financial Well-being

There are many resources available to help achieve both mental health and financial well-being. Access to these resources can make a significant difference. Finding the right tools can lead to a balanced and healthy life.

Online platforms offer a wealth of information and support. Websites like BetterHelp provide mental health counseling. Apps such as Mint help users manage their finances efficiently.

Community organizations also play a vital role. Many local community centers offer free financial literacy workshops. They often provide mental health support groups as well.

Employers are increasingly offering wellness programs. These programs might include financial counseling services. They also often feature mental health resources, such as Employee Assistance Programs (EAPs).

Educational institutions are stepping up as well. Some schools include financial literacy courses in their curriculum. Others provide mental health services through counseling centers.

Utilizing these diverse resources can improve overall well-being. Combining financial and mental health support ensures a holistic approach. This comprehensive support network can help individuals thrive.

Frequently Asked Questions

Understanding the connection between mental health and financial well-being is crucial. Here are some frequently asked questions to help clarify this relationship.

1. How can financial stress affect your mental health?

Financial stress can significantly impact your mental health by increasing anxiety levels. Worrying about bills, debt, and other financial obligations can lead to sleepless nights and constant worry.

This prolonged stress may result in depression and lowered self-esteem. Over time, it affects physical health, leading to headaches, fatigue, and other ailments.

2. What are some effective strategies to manage both mental health and financial well-being?

An effective strategy is creating a detailed budget that tracks all expenses. This control over finances reduces anxiety related to money management.

Combining budgeting with mindfulness techniques like meditation helps maintain overall mental well-being. Seeking support from professionals in both fields is also beneficial.

3. Are there any tools or apps that can help integrate financial planning and mental health?

Yes, several apps offer services that combine budgeting with mental wellness resources. Apps like Mint for managing finances and Headspace for meditation work well together.

These tools provide comprehensive support by addressing both financial issues and stress relief methods simultaneously. They are convenient ways to achieve balanced wellbeing.

4. How do integrated support programs work to improve both financial stability and mental wellness?

Integrated support programs offer combined services from financial advisors and mental health professionals. Workshops on budgeting paired with stress management sessions provide a holistic approach.

This dual approach ensures comprehensive care by tackling intertwined challenges concurrently. It promotes lasting solutions for better overall life quality.

5. Can improving financial literacy have long-term benefits for mental health?

Improving financial literacy equips individuals with skills needed to manage their finances effectively. This competence reduces anxiety linked to poor money management decisions.

The confidence gained from understanding finances delivers peace of mind and future security layers, fostering better long-term emotional stability.

Conclusion

The connection between mental health and financial well-being is undeniable, impacting many aspects of life. Understanding this relationship allows for more effective strategies to manage stress and improve overall quality of life. By integrating financial literacy and mental health support, individuals can achieve a holistic sense of well-being.

As society continues to evolve, the importance of addressing both financial and mental health needs will only grow. Utilizing available resources and adopting healthy habits can make a significant difference. Together, these efforts can lead to a more balanced and fulfilling life.